back to REAL ESTATE DICTIONARY

- Land Survey – in the simplest terms, it’s a graphic depiction of a property, much like a map, outlining its legal boundaries and other features. While land surveys typically aren’t required during real estate transactions, it’ very important when purchasing large parcels of land.

- Lead-Based Paint – or lead paint is paint containing lead. Children may become lead poisoned by putting their hands or other lead-contaminated objects into their mouths, eating paint chips found in homes with peeling or flaking paint. More Information at HUD.gov. and EPA.gov

- Lien – is a claim or legal right against assets that are typically used as collateral to satisfy a debt. Type of liens:

— Mechanical/contractor liens: mechanical liens result when homeowners hire contractors to perform home improvement projects but fail to pay them for their services and materials.

— Tax liens: tax liens are filed due to unpaid taxes, including local property tax liens and those filed by the IRS for missed federal tax payment

— Judgment liens: judgment liens result from court cases in which it was ruled that you owe money to the other party. They can include settlements related to child support, unpaid credit card debt, and medical bills.

— Mortgage Lien – is a legal right the lender has to take your property if you fail to pay your debt.

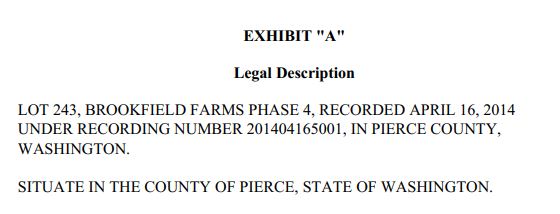

- Legal Description – is the geographical description of a real estate property for the purpose of identifying the property for legal transactions. A legal description of the property unambiguously identifies the location, boundaries, and any existing easements on the property. Sample:

- Listing – simply means a property is advertised. See also:

- Listing Agent or Seller’s Agent – a broker who markets seller’s property and represent the seller during the sale and the closing of the property.

- Listing Agreement – an agreement that represents the right of a real estate agent or Broker to handle the sale of real property and to receive a fee or commission for services.

- Loan – a loan advanced to a person to assist in buying a house or condominium. See Also:

- Loan Balance – loan balance is simply the remaining amount you have left to pay on your loan. It can often be different than the payoff amount, which is the amount you’d need to pay today to completely pay off your loan

- Loan Modification – Would you feel better about your ability to make future mortgage payments if the terms of the loan were different? If so, you need to speak with your lender about a loan modification. As the name suggests, this is when your lender alters the terms and conditions of your loan so you can afford to make future payments. For instance, the lender may agree to a longer term as a means of lowering your payment. Or maybe they allow you to add missed payments to the balance, thus starting fresh. There are many types of loan modification, so make sure you keep an open mind. You don’t want to turn down an offer just because it’s not exactly what you were looking for.

- Loan Origination Fee – is an upfront fee charged by a lender for processing a new loan application. It’s compensation for putting the loan in place. Origination fee is a percentage of the loan amount, and they’re generally between 0.5% and 1% on mortgage loans.

- Loan Value – see Principal Amount

- Low Appraisal – if appraised value of the property is less than purchase price. Multiple-offer situations in a seller’s market often drive purchase prices higher than any comparable sales in the area, and this can result in a low appraisal. This creates a problem for the buyer, because in this case Lender will lend money based on the Appraised Value (not purchase price). The deference between the Appraised Value and Sale Price needs to be negotiated between the buyer and the seller, if an agreement is not reached the buyer will have to bring the difference in cash at the closing table. Single family appraisal costs from $700-$1,200 (for rush appraisal). Multifamily, apartments, and commercial appraisals will costs more.